Blockchain technology has been making waves in recent years, with its potential to disrupt various industries and bring about major changes. One of the areas where blockchain is expected to have a significant impact is in banking. The integration of blockchain in banking has the potential to revolutionize the financial world, providing more secure, efficient, and transparent processes. In this article, we will explore the different aspects of blockchain technology and how it is transforming the banking sector.

What is Blockchain Technology?

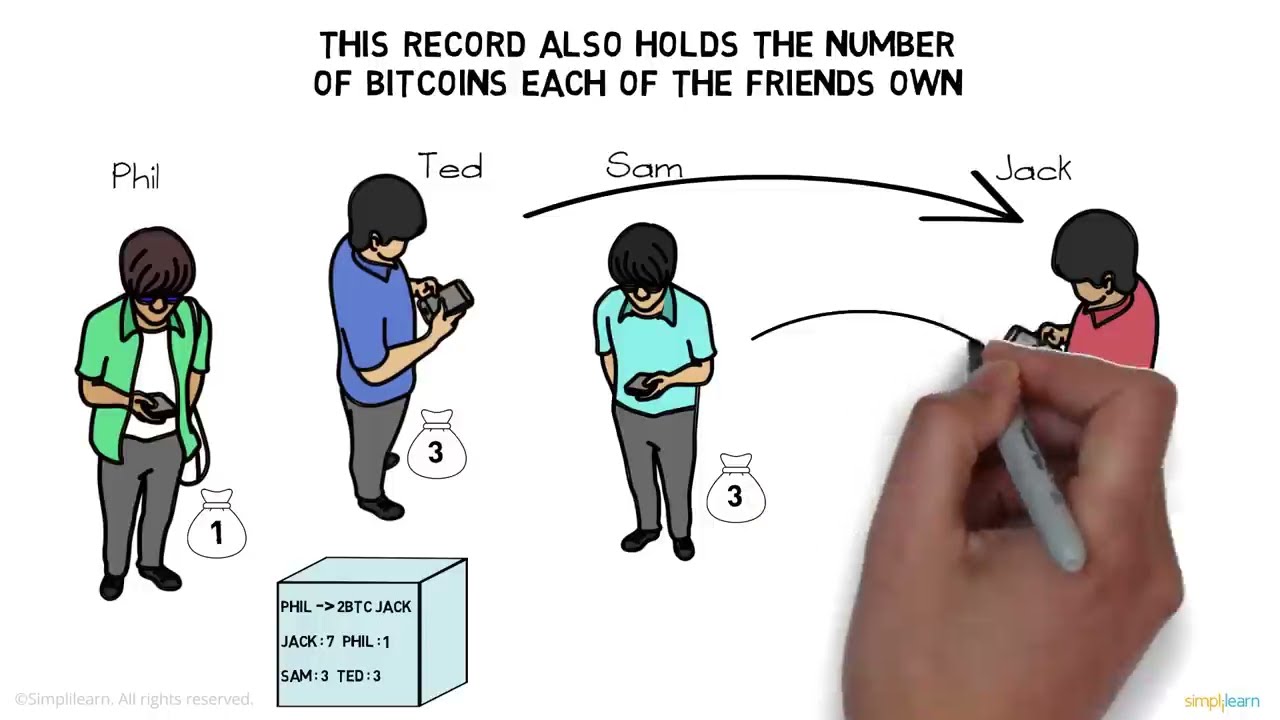

Before we dive into the integration of blockchain in banking, let’s first understand what blockchain technology is. At its core, blockchain is a decentralized digital ledger that records transactions in a tamper-proof and transparent manner. It was initially developed as the underlying technology for cryptocurrencies such as Bitcoin, but its potential goes far beyond that.

Blockchain works by creating a network of computers or nodes that work together to verify and record transactions. Each block in the chain contains a set of transactions, and once verified, it is added to the chain, creating a permanent and unchangeable record. This distributed nature of blockchain ensures that there is no central authority controlling the data, making it resistant to fraud and hacking attempts.

The use of cryptography further enhances the security of blockchain, making it virtually impossible to alter or manipulate the recorded data. This feature makes blockchain technology ideal for use in banking, where data integrity and security are crucial aspects.

How is Blockchain Being Integrated into Banking?

Now that we have a basic understanding of blockchain technology, let’s delve into the ways it is being integrated into banking. Here are some of the main areas where blockchain is changing the game in the banking sector:

1. Payment Processing

Perhaps the most obvious application of blockchain in banking is in payment processing. Blockchain-based payment systems can facilitate faster, cheaper, and more secure transactions compared to traditional methods. With blockchain, transactions can be completed in minutes, regardless of the location of the parties involved. This eliminates the need for intermediaries such as banks or payment processors, resulting in lower fees and faster processing times.

Blockchain-based payments also offer an added layer of security since all transactions are recorded on the ledger, making them virtually impossible to manipulate or falsify. This feature is especially appealing to merchants, who often fall victim to fraud and chargebacks from dishonest customers.

2. Identity Management

Identity theft and fraud are major concerns for the banking industry, with billions of dollars lost each year due to these issues. Blockchain technology can play a significant role in mitigating these risks by providing a secure and decentralized way of managing identities.

With blockchain-based identity management, individuals will have full control over their personal data, which can only be accessed by authorized parties. This reduces the risk of data breaches and identity theft, providing a more secure environment for banking transactions.

3. Trade Finance

International trade involves various parties, including buyers, sellers, banks, and shipping companies. The traditional paper-based processes used in trade finance can be time-consuming, inefficient, and prone to errors. Blockchain offers a solution by streamlining these processes, reducing paperwork, and providing a tamper-proof record of all transactions.

By digitizing trade finance processes, blockchain enables faster and more accurate transactions, making it easier for businesses to engage in international trade. This has the potential to boost global trade and improve the efficiency of supply chains.

How to Use Blockchain in Banking?

Now that we understand the different areas where blockchain is being integrated into banking let’s explore how it can be used in practice. Here are some examples of how blockchain is currently being used in the banking sector:

1. Cross-border Payments

One of the earliest use cases of blockchain in banking was seen in cross-border payments. Companies such as Ripple and Stellar offer blockchain-based payment solutions that enable fast and cost-effective cross-border transactions. By eliminating the need for intermediaries, these platforms reduce transaction fees and processing times significantly.

2. Digital Identity Verification

The integration of blockchain in banking has led to the development of digital identity verification platforms such as Civic and ShoCard. These platforms use blockchain technology to store encrypted personal data, allowing users to easily verify their identities without having to go through lengthy and cumbersome processes.

3. Smart Contracts

Smart contracts are self-executing contracts that automatically enforce the terms of an agreement between parties. They are powered by blockchain technology, making them secure and tamper-proof. Banks can utilize smart contracts to streamline various processes, such as loan approvals and trade finance, reducing the time and costs associated with these activities.

Comparing Blockchain-Based Systems to Traditional Banking Systems

To better understand the impact of blockchain technology on banking, let’s compare it to traditional banking systems. Here are some key differences between the two:

1. Decentralization

Traditional banking systems are centralized, with a single authority controlling all data and transactions. This makes them vulnerable to cyber attacks and fraud attempts. On the other hand, blockchain-based systems are decentralized, with no central authority controlling the data. This makes them more secure and resistant to attacks.

2. Speed and Efficiency

Blockchain-based systems are much faster and efficient compared to traditional banking systems. Since there is no need for intermediaries, transactions can be completed almost instantly, regardless of the location of the parties involved. This also eliminates the need for manual paperwork, reducing the chances of errors and delays.

3. Transparency

The integration of blockchain in banking brings about a new level of transparency in financial transactions. With blockchain, all transactions are recorded on a public ledger, making it easy to track and verify them. This increases trust and reduces the risk of fraudulent activities.

Advantages and Challenges of Integrating Blockchain in Banking

The integration of blockchain in banking offers several advantages, but it also comes with its own set of challenges. Here are some of the main pros and cons of using blockchain technology in the banking sector:

Advantages:

- Enhanced security: Blockchain technology provides an added layer of security to financial transactions, making them more resistant to fraud and hacking attempts.

- Faster processing times: By eliminating intermediaries, blockchain streamlines processes, resulting in faster and more efficient transactions.

- Cost savings: Blockchain-based systems reduce transaction fees, saving businesses and individuals money.

- Increased transparency: With all transactions recorded on a public ledger, blockchain brings unprecedented levels of transparency to financial transactions.

Challenges:

- Regulatory hurdles: The use of blockchain in banking is relatively new, and regulations surrounding it are still in development.

- Integration with legacy systems: Banks often have complex legacy systems that need to be integrated with blockchain-based solutions, which can be challenging and time-consuming.

- Scalability: As blockchain technology gains popularity, scalability becomes an issue, with existing systems struggling to keep up with the increasing volume of transactions.

Frequently Asked Questions about the Integration of Blockchain in Banking

Q1. What is the main benefit of integrating blockchain in banking?

A1. The main benefit of integrating blockchain in banking is increased security and efficiency in financial transactions.

Q2. Are there any challenges associated with the integration of blockchain in banking?

A2. Yes, there are challenges such as regulatory hurdles, integration with legacy systems, and scalability issues.

Q3. How does blockchain enhance the security of banking transactions?

A3. Blockchain enhances security by creating a decentralized system where all transactions are recorded on a tamper-proof ledger.

Q4. Can blockchain be used for international trade finance?

A4. Yes, blockchain can streamline trade finance processes, reducing paperwork and increasing efficiency in cross-border transactions.

Q5. What is the future of blockchain in banking?

A5. The future of blockchain in banking looks promising, with more and more banks and financial institutions embracing this technology to enhance their services.

Conclusion: The Future of Banking is Blockchain

The integration of blockchain in banking has the potential to transform the financial world for the better. From faster and more secure transactions to increased transparency and cost savings, the benefits of using blockchain technology in banking are numerous. While there are still challenges to overcome, the future certainly looks bright for this revolutionary technology. As more banks and financial institutions embrace blockchain, we can expect to see a more efficient and transparent banking system in the years to come.